Not known Details About Mileagewise - Reconstructing Mileage Logs

Wiki Article

10 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Table of ContentsWhat Does Mileagewise - Reconstructing Mileage Logs Do?7 Simple Techniques For Mileagewise - Reconstructing Mileage LogsNot known Details About Mileagewise - Reconstructing Mileage Logs Not known Facts About Mileagewise - Reconstructing Mileage LogsIndicators on Mileagewise - Reconstructing Mileage Logs You Should KnowMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Distance function recommends the quickest driving route to your staff members' location. This feature boosts efficiency and contributes to set you back savings, making it an essential property for services with a mobile labor force. Timeero's Suggested Course feature even more enhances responsibility and performance. Workers can contrast the suggested path with the real route taken.Such an approach to reporting and compliance simplifies the usually complex job of managing mileage costs. There are several benefits related to making use of Timeero to track mileage. Let's take an appearance at a few of the application's most notable features. With a relied on gas mileage tracking tool, like Timeero there is no demand to worry regarding accidentally leaving out a date or item of information on timesheets when tax obligation time comes.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

These extra confirmation procedures will keep the IRS from having a factor to object your gas mileage documents. With precise mileage tracking modern technology, your staff members do not have to make harsh gas mileage estimates or also fret regarding mileage cost tracking.

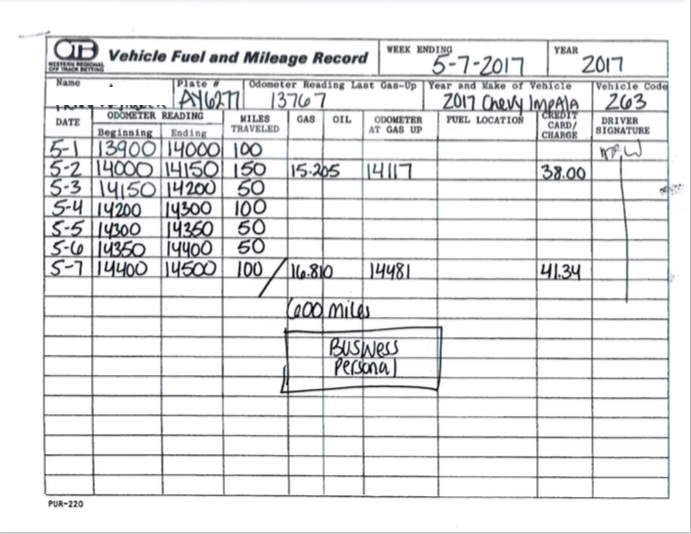

As an example, if a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all car expenditures. You will certainly need to proceed tracking gas mileage for job also if you're utilizing the actual expenditure approach. Maintaining gas mileage records is the only means to different company and personal miles and give the proof to the IRS

Many mileage trackers allow you log your journeys manually while calculating the distance and reimbursement amounts for you. Numerous additionally featured real-time trip tracking - you need to start the application at the begin of your trip and quit it when you reach your final destination. These applications log your beginning and end addresses, and time stamps, along with the overall range and compensation quantity.

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Among the concerns that The IRS states that vehicle expenses can be taken into consideration as an "average and required" price during doing service. This consists of costs such as gas, upkeep, insurance policy, and the web automobile's devaluation. For these expenses to be taken into consideration deductible, the vehicle must be used for company objectives.

Mileagewise - Reconstructing Mileage Logs for Beginners

Start by tape-recording your vehicle's odometer analysis on January first and afterwards again at the end of the year. In between, vigilantly track all your company journeys noting down the starting and ending readings. For every trip, document the place and business function. This can be streamlined by keeping a driving visit your car.This includes the total service mileage and total mileage build-up for the year (business + individual), journey's day, destination, and objective. It's crucial to record activities without delay and keep a synchronous driving log detailing day, miles driven, and service function. Right here's just how you can enhance record-keeping for audit objectives: Beginning with guaranteeing a thorough gas mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

The actual costs approach is an alternate to the common gas mileage price method. Rather of determining your reduction based upon an established price per mile, the real expenditures method permits you to deduct the real expenses associated with utilizing your automobile for company purposes - mileage tracker app. These expenses include fuel, maintenance, fixings, insurance, devaluation, and other relevant expendituresThose with considerable vehicle-related costs or unique problems might benefit from the real expenses approach. Eventually, your selected approach ought to straighten with your certain monetary objectives and tax obligation circumstance.

A Biased View of Mileagewise - Reconstructing Mileage Logs

(https://medium.com/@tessfagan90/about)Whenever you utilize your auto for company journeys, tape-record the miles took a trip. At the end of the year, again keep in mind down the odometer reading. Determine your complete business miles by utilizing your beginning and end odometer readings, and your videotaped organization miles. Properly tracking your exact gas mileage for company journeys aids in confirming your tax obligation reduction, specifically if you select the Criterion Gas mileage approach.

Tracking your mileage manually can need diligence, however keep in mind, it can save you cash on your tax obligations. Follow these actions: Write down the day of each drive. Tape-record the complete mileage driven. Think about noting your odometer readings prior to and after each trip. Write down the starting and finishing factors for your journey.

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

In the 1980s, the airline company industry ended up being the first commercial customers of general practitioner. By the 2000s, the delivery market had actually taken on general practitioners to track plans. And currently virtually everybody utilizes GPS to get about. That means nearly every person can be tracked as they go about their organization. And there's snag.Report this wiki page